Why Trade Options?

First some of the pros and cons, cons first.

Cons:

- They can change in value, on a percentage basis, much faster than the underlying stock. Of course this can be a huge benefit when it moves in your direction.

- They require more learning and discipline to trade than stocks.

- Although I never trade options with margin, they do require a margin account with the broker, a bit of a hassle compared to a regular stock account. It also means you can’t trade them in a retirement account.

- They require more time and attention than trading stocks.

PROS:

- The percentage of profit is much larger for a given move on the stock than owning the stock itself.

- You can trade with far less money than with stocks, a couple thousand is fine to start with.

- When done correctly you can make good money with a 3 to 1, or 4 to 1 loose/win ratio.

- With a couple of exceptions for exits, I use the same technicals for options as I do for stocks, no new learning required there!

- You can trade to the short side in down markets without margin!

Some Terminology:

What is an option?

When you buy (I never sell options, that takes margin) an option you are entering a contract to either buy (a call option) or sell (a put option) 100 shares of the underlying stock at a specified price (the strike price of the option) at a specified date in the future (the expiration date of the contract). I simply sell the option contract whenever it’s time and move on the the next trade.

Strike prices – at the money, in the money & out of the money

An at the money strike price means the the strike is equal to the price of the underlying stock, or at least very close to it. I always buy at the money for reasons I’ll explain later. An in the money strike price (for a call contract) means the price of the stock is greater than the strike price of the contract. An out of the money strike price (for a call contract) means the price of the underlying stock is below the contract strike price.

For put contracts, playing a stock to the downside, reverse the above.

Bid & Ask price

Pretty simple here. The bid price is what you will pay for a contract when you buy it, the ask price is what you will get when you sell it. The platform I use, Think or Swim (TOS) will by default always enter your buy and sell orders as limit orders. This is a safety measure to make sure that on a thinly traded contract you don’t get taken for a bad ride with a market order. Some folks would be concerned that with a limt order in a fast moving market you might miss the trade. This could be bad or good depending on price action. However in my experience, and because I don’t trade low volume stocks, all of my limit orders are virtually instantaneous.

Slightly More Confusing, the Greeks: Delta, Theta, Gamma, Vega & Rho.

The Greeks are how the price of an option contract is determined and control the price variations as time and stock price change. Here are the definitions but don’t freak out, I only pay attention to two of them!

Delta – measures the change in an option’s price for a $1 move in the underlying.

Theta – Also called “time decay,” theta measures the dollar change in an option’s price based on the passage of time.

Gamma – This quantifies the rate of change of delta. Some traders call it the gas pedal of delta. Why? Delta is not a constant—it ranges from zero (for a far out-of-the-money option) to 1.00 for a deep in-the-money option

Vega – measures the change in an option’s price based on a 1% move up or down in the implied volatility of the underlying.

Rho – reflects changes in interest rates, specifically the “risk-free” interest rate, typically a Treasury bill with a maturity date that aligns with the option’s expiration date

So which two do I care about?

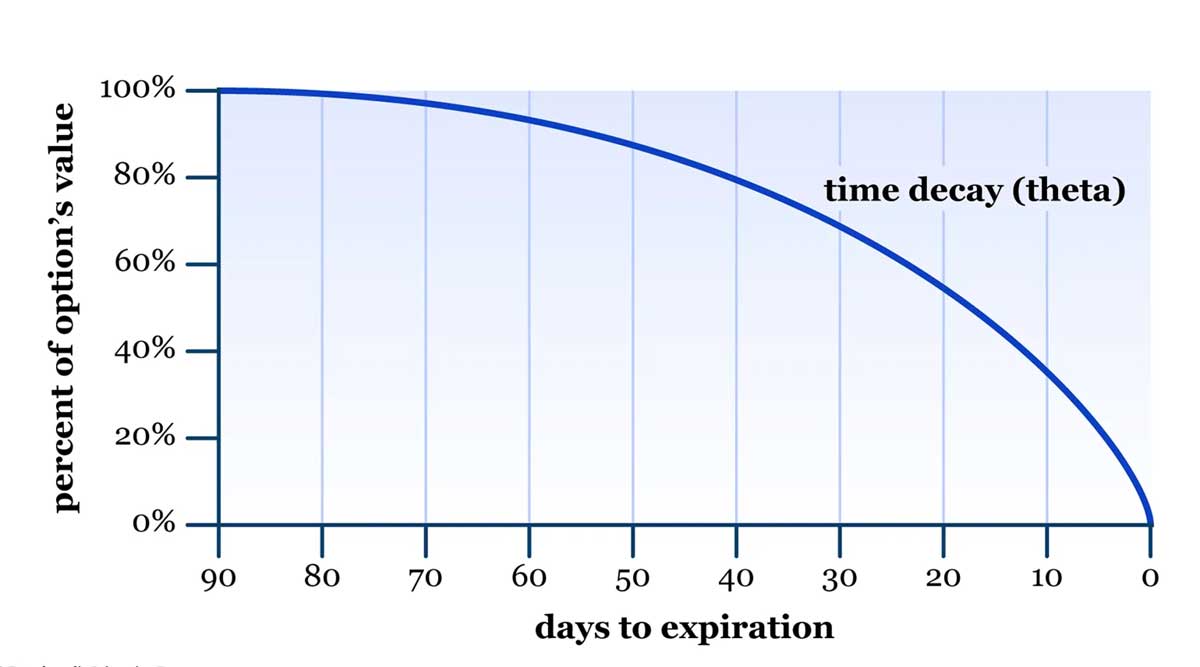

The first two, Delta & Theta. Here’s why, first Theta, the change in price of the contract with time. The first thing to know is buying time costs more money so why buy time? Simple, to give yourself time to be right. I very rarely buy an option thinking I may exit soon, although I’ll show you a painful example of failure below. A day trader won’t waste money on buying theta, they look for cheap and fast trades. Look at the graph of Theta below:

Notice how fast the time decay of value gets in the last 30 days. If your underlying stock is moving kinda slow, going sideways, or even against you a bit, but you still think you are correct on it’s future price movement I want my Theta to be over in the 60 – 40 day area to not get hammered by the decay curve over in the last 30 days area. With one exception I’ll show below, I never buy a contract with less than 60 days left on it, sometimes I’ll buy as much 90 days out.

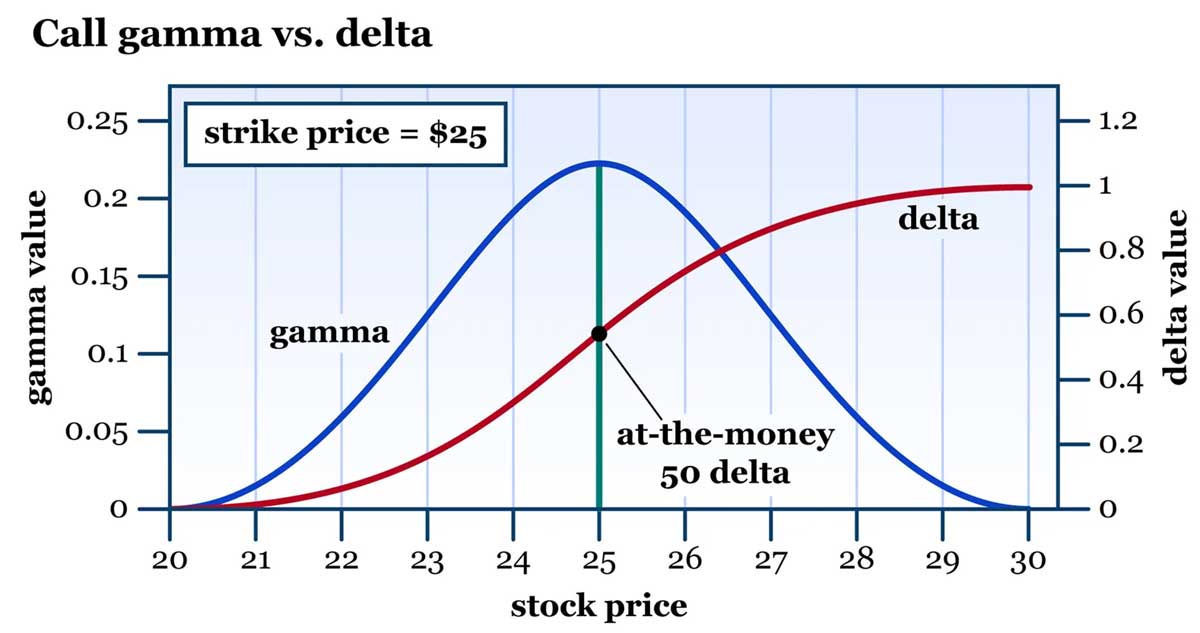

Next up – Delta & Gamma

Before I move on there’s an important thing yo need to understand about how option contracts are priced. While it’s pretty simple, it can be a bit confusing when you’re first starting out with options. So here’s the deal. I mentioned above that an option contract controls 100 shares of the underlying stock. This plays into the pricing of the bid & ask prices. If you look up an ask price for a stock you might see something 1.25 ask. However to get the actual value of the contract as well as how much you would pay for it, you need to multiply the ask price by 100. So this contract would cost you $125.00. An ask price of 0.35 would cost you $35/contract, etc. Pretty simple once you understand it.

Now look at the graph of the relationship between delta, gamma, and the price of the underlying stock. Notice that the contract strike price is $25 and the ‘at the money’ part of the graph is the green line at the center. You can see that the gamma, the amount delta changes as the price of the stock changes, peaks in ine middle when the stock price equals the strike price. This is where the slope of delta is the steepest, it’s rate of change is maximum. You should also note that delta peaks out right around 1, or dollar for dollar, when the stock price is on the money by $5.00 on the far right side.

An important clarification here. Because of that 100 multiplyer I mentioned above, a change in the ask price of your contract of $1.00 means that the value of the contract has increased by $100.00.

Also notice the below example is for a call contract, a put would flip everything around.

The above graph shows why I always buy as close to ‘at the money’ contracts as possible. If I’m right on the direction and magnitude of the stocks movement for the next few weeks after purchase, I maximize my gains. The opposite is also true, I lose value quickly. I’ll discuss the downside movement elsewhere and another lesson I learned recently that cost me about a grand.

Now check out two option trades I did recently with GE, they were nice sweet trades, very low stress. But first bit of a prelude here. First note the time scale, roughly 6 months of a daily chart beginning Oct 2023 – today, March 20,2024. Also notice the total price change on GE, from about 105 to a recent high of 175, roughly 70% in six months, very nice smoothe uptrend too. The small red text (detaled below) shows when I entered and exited twice beginning early Feb, 2024. I had been watching GE since I nailed the bottom of the markets in Oct, but I was all in, 100% invested in my main account so I had no funds to get into GE. However I did have some funds in my small option account!

So I broke my rules. If you look where my first option buy was there in Feb and check the stochs below it, you’ll see that it stayed overbought for a long time. It wouldn’t give me a pull back to make a classic entry. Then I recalled something I read in a book called Market Wizards. It was in the section where the author Schwager was interviewing one of the famous Turtle Traders. A good book BTW, worth the read. Anyway the Turtle Traders were famous, all MIT guys I believe. They had been thrown out of Vegas for winning too much. Their holy grail was risk management.

After getting tossed by the mob they decided to apply their methods to the stock market and they all became millionaires. So as Jack was interviewing one of them in his home on Lake tahoe, he asked the guy how do you know when to buy? The response was simple, he said I print out a one year chart, tape it to the wall in my office. Then I walk across the room and look at it, if it’s going up I buy it. After that it’s all about risk management!

Well shit I thought, GE is screaming so I’m going for it, with options ‘cuz that’s all I had cash for. To be fair I did use stochs to time my buys on interday time frames, meaning I wanted the 15 minute fast stoch to be crossing the slow one to the upside, but in retrospect it was a worthless use of time.

So what happend? Here’s a summary of my two trades:

2/8/24 – bought 28 march 139 call @ 4.95

2/15/24 – sold 28 march 139 call @ 13.10 – 2.64

2/25/24 – bought 19 april 155 call @ 6.76

3/13/24 – sold 19 april 155 call @ 13.55 – 2.00

total cost – 11.71, total sale value – 26.65, – 2.28

Summary: total cash invested was $1,171.00, total profit made was $1,494. That’s about 228% in six weeks. Owning any of the stock over the same time period would have netted you about 29% profit. It would also have tied up a lot of funds. Imagine if I was trading a bit larger account and bought 5 contracts each time!

A reasonable question to ask would be why did I exit realitivly fast when the stock was doing so well? The main reason was I try to adhere to the concept of not being greedy, if I have decent profits, cash it in and live to trade another day. On the first trade I was also getting close to the 30 theta decay window, I hadn’t bought a lot of time on the contract.

The most expensive nap I’ve ever taken

This next trade is the first mistake I’ll tell you about. Mistakes are important, we need to learn from them. It’s also easily the most painful trade situation I’ve ever had, and I never lost a cent! The stock was NVDA, and I had a postion in it already in my IRA account. But I was sitting on about $1,100.00 cash in option account and I was anxious to put it to work. I noticed that NVDA was selling off pretty hard going into an earnings announcment on I believe it was 2/21/24, a Wednesday. It’s the yellow arrow labeled ‘A’ in the drawing. I told myself that the sell off was bullshit, likely perpetuated by some fools with a lot of cash to try and do the same thing I was contemplating, buy some call contracts as cheap as possible before the blowout earnings call after hours.

A bit of supporting info is needed here. I’ve had, and still put up with some pretty serious health issues. The symptoms include brain fog and severe fatigfue.

So I was watching the price of the stock on this Wednesday, trying to grab the best price as it kept going down, dropping the price of the call contract I was looking at. I was pricing a front month (I didn’t want to pay for any theta because I was sure the stock would pop the next day and I was intending on selling for a quick profit) and it was going for about $945.00 the last time I looked at it. But I got very tired so I went and layed on the couch… and fell asleep! When I woke up, the bell had rang, my chance was gone.

As you can see from the chart below, the price the next day, arrow ‘B’, had gone from around $675 at the Wednesday close to around $770.00 the next day. That’s about a $100 move folks, which translated to roughly $11,000 the next day on the option contract I was going to buy! I had missed out on turning $945 into over $10,000.

To say I was bummed is a major statement.

I mentioned it to a friend who is an investor and his smart assed coment was ‘you snooze you loose’. But that’s not actually the case.

When I worked in the nuclear business they taught us a very useful process called root cause analysis. The concept was to identify the true, actual ‘root cause’ that led to the failure we were dealing with, either procedural or hardware based. As I though about my blown trade I realized that the root cause wasn’t that I took the nap. The true root cause was that I foolishly and greedily hesitated in buying the contract because I was trying to save $20 or $30 on the the damn thing!

What a dumb assed mistake!

So here’s the rule – don’t be stupid and greedy! As the saying goes in trading, Pigs get slaughtered!

This next failure has sooooo much wrong with it I have a hard time believeing I actually did it!